National housing market activity gained momentum in final quarter of 2024, resulting in moderate price gains

By: Royal LePage

TORONTO, January 14, 2025

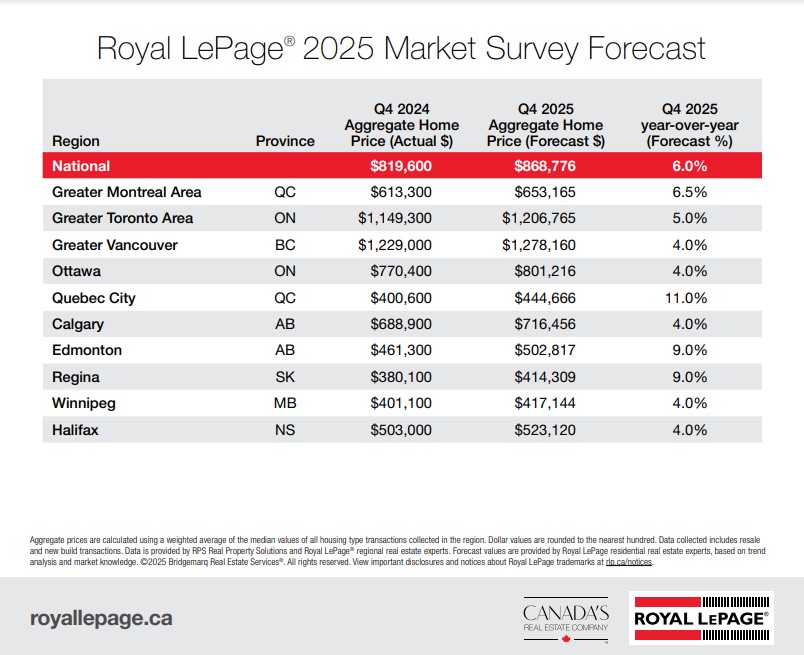

According to the Royal LePage® House Price Survey released today, the aggregate[1] price of a home in Canada increased 3.8 per cent year over year to $819,600 in the fourth quarter of 2024. On a quarter-over-quarter basis, the national aggregate home price remained essentially flat, rising a modest 0.5 per cent. While activity began to flourish again in the final months of 2024, following sluggish demand in most major markets over the summer, home price appreciation remained in check last quarter.

“There are several converging factors revitalizing Canada’s real estate market and making home ownership more attainable,” said Phil Soper, president and CEO, Royal LePage. “Interest rates have fallen sharply in recent months, with further reductions expected in 2025. We believe the Bank of Canada could lower rates by another 100 basis points by year end, steadily improving affordability. At the same time, new mortgage rules are already helping younger Canadians by increasing borrowing power and reducing monthly carrying costs.

Read full article HERE

REGIONAL SUMMARIES

Greater Toronto Area

The aggregate price of a home in the Greater Toronto Area (GTA) increased 2.3 per cent year over year to $1,149,300 in the fourth quarter of 2024. On a quarterly basis, however, the aggregate price of a home in the GTA decreased slightly by 0.6 per cent.

Broken out by housing type, the median price of a single-family detached home increased 3.9 per cent year over year to $1,427,500 in the fourth quarter of 2024, while the median price of a condominium dipped 0.7 per cent to $714,600 during the same period.

“We saw sales activity begin to pick up at the end of 2024, with more showings and more appointments in certain markets. This trend should continue well into 2025. All indicators point to better market conditions for buyers, including first-time homebuyers,” said Shawn Zigelstein, broker and leader of Team Zold, Royal LePage Your Community Realty. “Declining lending rates and changes to mortgage regulations will make it easier for buyers in Toronto and the surrounding regions to take their time and find the right deal for them. There’s enough inventory right now to keep a lid on price gains, and we shouldn’t see the multiple-offer frenzy that characterized peak markets, except on properties that are priced below market value.”

Shawn Zigelstein noted that activity in the townhome segment is currently leading the market, due to the property type’s relative affordability. Meanwhile, condominium sales have continued to stagnate.

In the city of Toronto, the aggregate price of a home decreased 1.7 per cent year over year to $1,099,900 in the fourth quarter of 2024. During the same period, the median price of a single-family detached home rose a modest 1.2 per cent year over year to $1,621,900, while the median price of a condominium decreased 2.7 per cent to $681,200.

“Despite improvements in market conditions, there are many factors at play that could impact consumer confidence, and in turn activity, including political instability in Ottawa, friction with the U.S. government, and a weakening Canadian dollar. For this reason, I don’t anticipate a sudden wave of demand or a huge burst of sales. Rather, a gradual increase in market activity should unfold, which will ultimately be beneficial for both buyers and sellers.”

Royal LePage is forecasting that the aggregate price of a home in the Greater Toronto Area will increase 5.0 per cent in the fourth quarter of 2025, compared to the same quarter last year.

Fourth quarter highlights:

- The national aggregate home price rose 3.8% year over year in Q4 2024, and a modest 0.5% over Q3.

- Greater Montreal Area’s aggregate home price increased 8.2% year over year, while the greater Toronto and Vancouver markets recorded more modest gains of 2.3% and 0.7%, respectively.

- Royal LePage is forecasting that the aggregate price of a home in Canada will increase 6.0 per cent in the fourth quarter of 2025, compared to the same quarter in 2024.

- Housing policy and affordability expected to be key ballot box issues shaping voters’ decisions in this year’s federal election.