Prices decreased year-over-year in Greater regions of Toronto and Vancouver, while Quebec, the Prairies and Atlantic Canada recorded price appreciation

By: Royal LePage

TORONTO, April 15, 2025

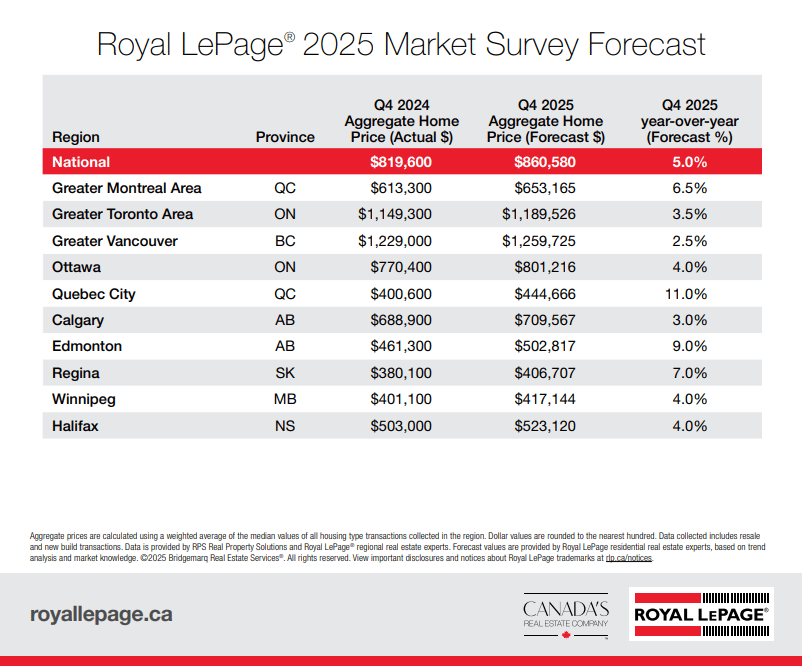

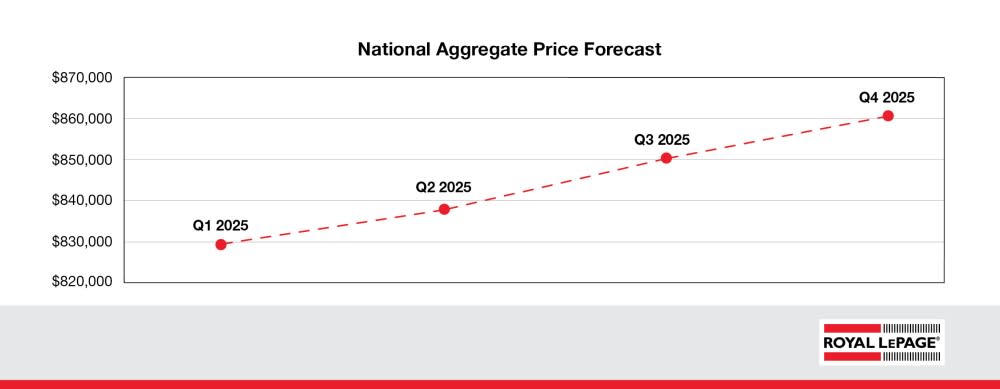

According to the Royal LePage® House Price Survey and Market Forecast released today, the aggregate1 price of a home in Canada increased 2.1% year over year to $829,400 in the first quarter of 2025. On a quarter-over-quarter basis, the national aggregate home price rose a modest 1.2%.

While housing market activity has been softer than expected so far this year in many markets – a major shift compared to where we ended 2024 – the trend has been especially pronounced in Ontario and British Columbia, the country’s most expensive markets. Meanwhile, comparatively strong demand paired with low supply has led to price appreciation in the province of Quebec, the Prairies and much of Atlantic Canada, despite ongoing geopolitical tensions and economic uncertainty.

Read full article HERE

REGIONAL SUMMARIES

Greater Toronto Area

The aggregate price of a home in the Greater Toronto Area (GTA) decreased 2.7 per cent year over year to $1,146,100 in the first quarter of 2025. On a quarterly basis, the aggregate price of a home in the GTA remained relatively flat, dipping 0.3 per cent.

Broken out by housing type, the median price of a single-family detached home declined modestly by 0.5 per cent year over year to $1,446,900 in the first quarter of 2025, while the median price of a condominium declined 4.0 per cent to $703,900 during the same period.

“The spring market has not sprung in Toronto. In fact, we’ve seen a very non-traditional start to the season, to say the least. A unique set of circumstances are at play – there’s a general sense of unease due to the ongoing trade conflict with the United States and its impact on the Canadian dollar and global stock markets, as well uncertainty over our own country’s political future with a federal election underway,” said Shawn Zigelstein, broker and leader of Team Zold, Royal LePage Your Community Realty. “Under normal circumstances, this would be a great time for buyers to get into the market: home prices and lending rates are declining, and supply is increasing. It’s clear that consumer confidence is low, and that’s driving a major slowdown in the GTA housing market.”

According to a recent Royal LePage survey, conducted by Burson, 48 per cent of Torontonians say they are confident in the country’s economy today, including only five per cent who are very confident. Meanwhile, 45 per cent say they are not confident. Among those in the region looking to purchase a home this year, 66 per cent say the ongoing trade dispute with our southern neighbour has caused them to postpone their home buying plans, while 34 per cent say it has not.

In the city of Toronto, the aggregate price of a home decreased 3.1 per cent year over year to $1,124,600 in the first quarter of 2025. During the same period, the median price of a single-family detached home dipped by a modest 0.8 per cent year over year to $1,693,200, while the median price of a condominium decreased 3.9 per cent to $686,700. On a quarterly basis, however, property prices in the city increased moderately.

According to the Toronto Regional Real Estate Board, sales volumes were down more than 23 per cent in March, compared to a year prior, following double-digit declines in the month of February.

“It’s important to distinguish that we’re seeing a market shaped by caution, not desperation. Inventory is increasing and new listings are continuing to come online, but sellers – in the vast majority of cases – are not panicking. Average days on market are up, but prices have not collapsed; sellers are being patient,” noted Zigelstein. “Buyers who are active today tend to be those who’ve managed their savings well. What they’re finding is a large selection of properties and the luxury to be able to negotiate terms and take their time. Generally, market conditions are fairly balanced, notwithstanding the condo segment. Condominiums may be discounted, but activity is still sluggish. Even with deals on the table, buyers in this market are hesitant.”

Looking ahead, Zigelstein expects a late spring market could emerge following the federal election, even into the summer months, provided the situation with the U.S. does not deteriorate further.

Royal LePage is forecasting that the aggregate price of a home in the Greater Toronto Area will increase 3.5 per cent in the fourth quarter of 2025, compared to the same quarter last year. The previous forecast has been revised down modestly to reflect current market conditions.

Royal LePage House Price Survey Chart: rlp.ca/house-prices-Q1-2025

Royal LePage Forecast Chart: rlp.ca/market-forecast-Q1-2025

Consumer Confidence Survey Chart: rlp.ca/2025-consumer-confidence-survey

Forecast

First quarter highlights:

- The national aggregate home price rose 2.1% year over year in Q1 2025, and a modest 1.2% over Q4 2024.

- Greater Montreal Area’s aggregate home price increased 7.9% year over year, while the greater Toronto and Vancouver markets recorded declines of 2.7% and 0.7%, respectively.

- Quebec City continues to lead the country in aggregate price appreciation, rising 17.0% year over year in Q1; the highest increase among the report’s major regions for the fourth consecutive quarter.

- Amid economic and political uncertainty, confidence in the economy is split: 49% of Canadians say they are confident, while 43% are not.