Toronto’s Vacant Home Tax (VHT) Program requires all residential property owners to declare the occupancy status of their property(s) every year.

As a residential property owner, you need to let us know every year whether your property is occupied or vacant, even if you live at your property – so that only homes kept empty are impacted by the program. The deadline to make a declaration of your property’s 2025 occupancy status is April 30, 2026.

Revenue collected from the Vacant Home Tax is used to fund affordable housing initiatives, including the City’s Multi-Unit Residential Acquisition Program to help non-profit housing providers buy private market rental units, turn them into non-profit housing and keep rents affordable.

A property is not vacant, and the Vacant Home Tax will not apply, if:

· it’s your principal/main residence (you live and receive mail there)

· it’s the principal residence of a family member, friend, or other permitted occupant

· it was occupied by a tenant (including a business tenant) for at least six months in 2025.

If your property meets any of the above points, the Vacant Home Tax does not apply – as long as you or someone acting on your behalf completes a Vacant Home Tax declaration by the deadline of April 30, 2026. If your declaration is not received by this deadline, your property will be deemed vacant, and a VHT Notice of Assessment will be issued. The Vacant Home Tax is calculated at 3% (three per cent) of a property’s Current Value Assessment (CVA).

HOW TO DECLARE:

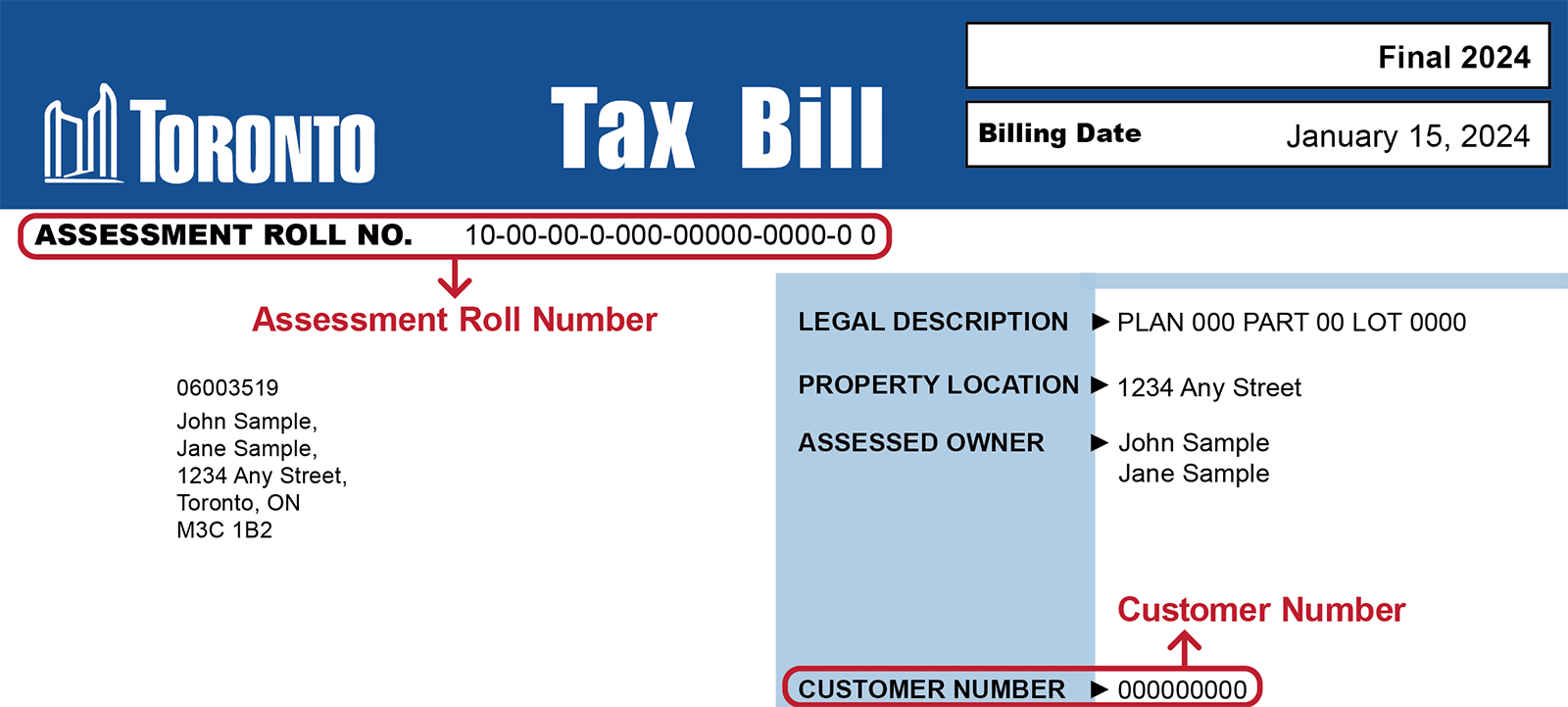

Online: Visit toronto.ca/VacantHomeTax. The information you need to make your VHT declaration can be found on your recent property tax bill.

Phone: Call 311 within Toronto or 416-392-2489 from outside the city. They speak 180 languages.

In-person: Visit a Tax and Utility counter at Toronto City Hall or any civic centre.

Although the deadline to submit your 2025 declaration is April 30, 2026, we encourage you do this as soon as possible.

If you recently made your declaration, there is no further action required.