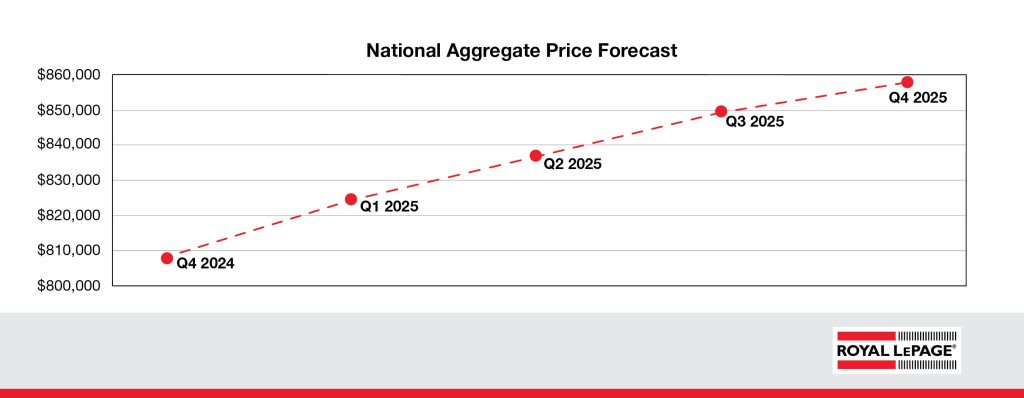

National aggregate home price forecast to increase 6.0% year over year in Q4 of 2025

By: Royal LePage

Read the full article «here»

For the last few years, the Canadian housing market has experienced trends far outside the norm. A global pandemic, rapidly rising interest rates and economic disruptions threw the real estate market off course for a time, but 2025 is expected to bring conditions back in line with long-term historical averages.

According to the Royal LePage Market Survey Forecast, the aggregate price of a home in Canada is set to increase 6.0% year over year to $856,692 in the fourth quarter of 2025, with the median price of a single-family detached property and condominium projected to increase 7.0% and 3.5% to $900,833 and $605,993, respectively.

“After several years of unusual volatility in the real estate market, key indicators point to a return to stability in 2025. The backlog of willing and able buyers continues to grow, and upcoming changes to mortgage lending rules will further enhance Canadians’ borrowing power,” said Phil Soper, president and chief executive officer, Royal LePage. “Most notably, the Bank of Canada’s shift from ‘inflation fighter’ to ‘economy booster’ has taken time to influence buyer behavior. We saw a marked increase in market activity at the start of the fourth quarter, following the Bank of Canada’s 50-basis-point rate cut. Buyers now believe home prices have hit bottom and are eager to act before competition intensifies.”

Royal LePage 2025 Market Survey Forecast Table: rlp.ca/table-2025-forecast

New lending rules to boost buyer borrowing capacity

A series of new lending regulations are set to take effect this month, offering greater accessibility to both first-time buyers and current homeowners. As of December 15th, eligibility for 30-year amortizations on insured mortgages will be expanded to all first-time homebuyers and to all purchasers of new construction properties, up from the current 25-year threshold.3 In addition, the mortgage insurance cap will increase from $1 million to $1.5 million, allowing buyers with a down payment of less than 20 per cent the opportunity to explore housing options at a higher price point. This will be especially impactful for homebuyer hopefuls in the country’s priciest real estate markets, where average property values often exceed $1 million.

“Improved lending conditions, combined with declining interest rates, will unlock new housing opportunities for many Canadians in the new year. First-time buyers will be the primary beneficiaries of these initiatives, as their ability to borrow more for less with a smaller down payment will help bring them closer to their first home purchase,” said Soper. “We believe the return of buyers to the market will encourage builders and trigger a wave of new supply, which is very much needed.

“Addressing Canada’s critical housing shortage must remain a top priority for policymakers at every level of government. With our population growing rapidly through both natural increases and immigration, it is essential to stay focused on supporting the development of new homes if we hope to address housing affordability, be it for purchase or rent.”

Changing political landscapes create potential impact for housing

2025 will bring a change in government south of the border, and potentially in Canada’s House of Commons. New leadership, in addition to evolving trade relations, immigration policies and global conflict, could meaningfully alter the state of the Canadian housing market.

“With an election approaching in Ottawa and a new administration preparing to take office in Washington, the housing market faces potential disruptions. Here at home, a federal election will see new housing policies that may temporarily impact market activity in the second half of 2025,” said Soper. “Meanwhile, south of the border, the incoming Trump administration’s trade policies and broader economic agenda have the potential to create ripple effects for Canada’s economy and housing market. While these impacts may take time to unfold, they could eventually affect consumer confidence and market dynamics on both sides of the border.”

Canadian property price appreciation set for a return to long-term norms in 2025

Royal LePage® predicts declining interest rates and new lending rules will bring buyers back to the market next year

Highlights from the release:

- Greater Montreal Area aggregate home price appreciation (6.5%) expected to outpace greater regions of Toronto (5.0%) and Vancouver (4.0%) next year.

- Quebec City is forecast to see the highest gains among all major regions in 2025, with the aggregate home price expected to rise 11.0%, followed by Edmonton and Regina at 9.0%.

- Calgary, which saw unprecedented price appreciation and sustained activity over the last two years, is forecast to see home prices increase a moderate 4.0%, along with Ottawa, Halifax and Winnipeg.

- Median price of a condominium in the Greater Toronto Area expected to decline modestly by 1.0%, with thousands of new units to be added to the current surplus of supply

Greater Toronto Area

In the Greater Toronto Area, the aggregate price of a home in the fourth quarter of 2025 is forecast to increase 5.0 per cent year over year to $1,225,770. During the same period, the median price of a single-family detached property is expected to rise 7.0 per cent to $1,523,466, while the median price of a condominium is forecast to decline modestly by 1.0 per cent to $714,285.

“When the Bank of Canada first began making cuts to interest rates midway through the year, sidelined buyers in the GTA seemed resolute in their commitment to hold out for prices to reach their floor. Following the supersized rate cut made in October, the tide began to turn and activity picked up materially. This momentum is expected to persist through the winter months, giving way to an early spring market in 2025,” said Shawn Zigelstein, broker and leader of Team Zold, Royal LePage Your Community Realty. “While this boost in activity has not translated into an increase in prices just yet, inventory that had been building up over the past several months is now being quickly absorbed. Another significant batch of supply is unlikely to come online before spring, meaning buyers reentering the market will start to feel competition heat up and see some upward pressure on prices.”

Shawn Zigelstein noted that detached homes are poised to lead the region in price gains, as most new developments are focused on higher-density projects, leaving this segment perpetually low on supply. However, the condominium segment, which currently has a glut of inventory, is on a different trajectory.

“Toronto’s condo market is the softest it’s been in recent history, specifically in the downtown core. With interest rates expected to ease further, thousands of new units slated for completion next year, and new lending policies that will ease the burden of monthly carrying costs, this is a rare window of opportunity for first-time buyers,” said Zigelstein. “The wave of new condo units set to hit the market will offer a period of better affordability, but it will be short lived. Fewer project starts today mean a period of ultra-low completions several years from now. The eventual return of real estate investors to this segment will result in increased competition down the road.”

Read Royal LePage’s 2025 Market Survey Forecast for national and regional insights.

Royal LePage 2025 Market Survey Forecast Table: rlp.ca/table-2025-forecast