Mapping the million: How much home can $1M buy in major real estate markets across Canada

By: Royal LePage

Read the full article »here«

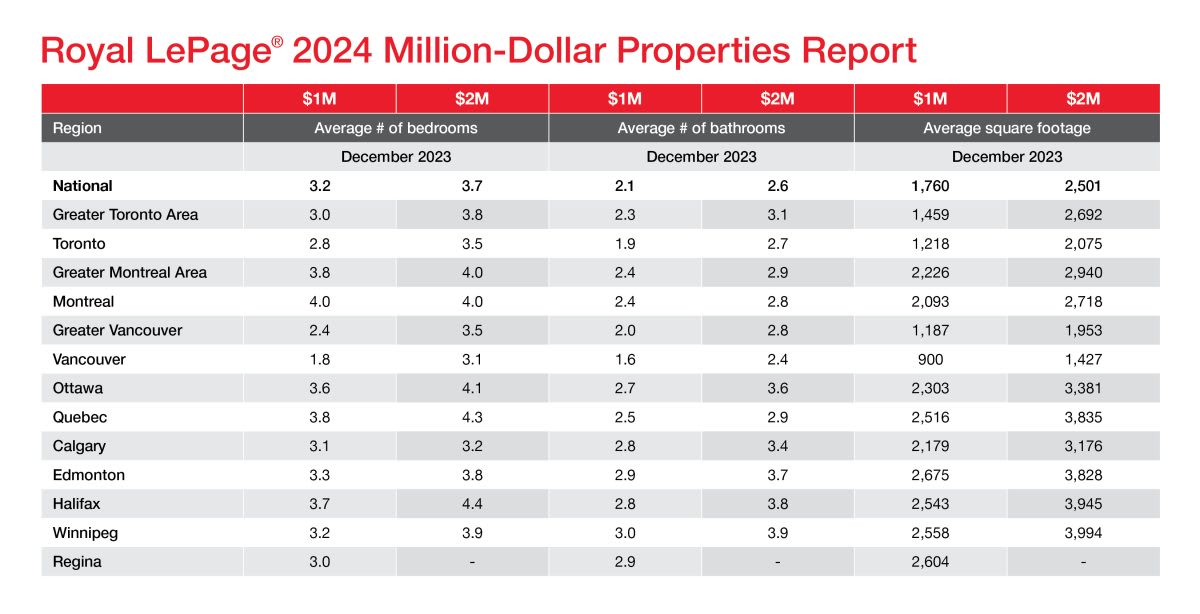

Nationally, a typical $1-million home boasts an average of 1,760 square feet of living space, about 740 less than a typical $2-million property

Key highlights from the 2024 Market Survey Forecast:

- On average, a $1-million property in Canada has 3.2 bedrooms and 2.1 bathrooms, while a $2-million property has 3.7 bedrooms and 2.6 bathrooms

- Edmonton boasts highest average square footage of all regions in the report (2,675 sq. ft.), while Vancouver records lowest (900 sq. ft.) in the $1-million category

- Cities and greater regions of Toronto and Vancouver rank below national average in square footage for $1-million properties, while the Greater Montreal Area boasts an average home size of 466 square feet larger than the national average

- Winnipeg and Halifax record largest average home size in $2-million category at almost 4,000 square feet

- Two thirds of Canadians overall (64%) believe that $1 million is a reasonable budget to afford a home that meets their household’s needs; that figure is significantly lower in Ontario (53%) and British Columbia (42%)

TORONTO, February 22, 2024 – In examining what a budget of approximately $1 million – give or take $50,000 – can buy in Canada’s major housing markets, Royal LePage® determined in a new report that the average home in Canada valued between $950,000 and $1,050,000 in December of 2023 had 3.2 bedrooms, 2.1 bathrooms and 1,760 square feet of living space, inclusive of all property types.[1]

Nationally, what $1 million can buy in Canada’s real estate market remains largely unchanged year over year, as a result of a major slowdown in activity and only modest property price growth. By comparison, in December of 2022, a home worth approximately $1 million had on average 3.2 bedrooms, 2.6 bathrooms, and 1,763 square feet of space.

“Depending on the market that you are shopping in, a $1-million home can mean something very different. In Calgary, a budget of $1 million is considered the move-up price point for existing homeowners. In Vancouver, the same amount is often the starting point for entry-level buyers,” said Karen Yolevski, COO, Royal LePage Real Estate Services Ltd. “Years ago, a $1-million budget could buy a generous amount of square footage and access to sought-after neighbourhoods in almost any market. Over time, however, we have watched the purchasing power of $1 million vary more widely between cities. These days, this budget can buy a luxurious detached home in one location, or a two-bedroom condominium in another.”

Unsurprisingly, for buyers shopping in the $2-million range, a larger budget buys significantly more space. The average home in Canada valued between $1,950,000 and $2,050,000 in December of 2023 boasted 3.7 bedrooms, 2.6 bathrooms and 2,501 square feet of living space, inclusive of all property types.

Higher interest rates, down payment rules add extra hurdles for buyers

Home prices have flatlined over the past year, a symptom of sidelined buyer demand as consumers face more strenuous mortgage qualification standards and rising borrowing costs. The Bank of Canada’s key lending rate currently sits at five per cent, its highest level in more than two decades. A comparative shortage in housing supply has continued to keep prices stable despite decreased activity. While the central bank is expected to make its first cut to interest rates later this year, borrowing costs will remain well above the ultra-low levels seen at the start of the pandemic for the foreseeable future.

“While on paper a budget of $1 million will get you a similar-sized home today compared to a year ago, monthly carrying costs have increased significantly as mortgage payments have continued to rise from historic lows. Regardless of budget, many buyers in today’s market are facing affordability challenges, forcing compromises to be made on location, property type and size,” said Yolevski.

When buying a home priced at $1 million or more, Canadian mortgage lenders require a minimum down payment of 20 per cent of the purchase price, equal to at least $200,000. Mortgage insurance, which is mandatory for homes bought with less than 20 per cent down, is not available to properties sold over the $1-million mark.

“The greatest barrier to entry when buying a home is often the down payment. For first-time homebuyers living in communities where entry-level homes start at $1 million or close to it, getting a foot on the property ladder can be a considerable challenge. This is why it’s become increasingly common for parents and family members to step in with financial assistance.”

Elevated interest rates, which have forced homebuyers to pass the mortgage stress test at higher qualification thresholds – given that rates have exceeded the 5.25 per cent minimum – have curbed the amount of money banks are lending to clients, making it more difficult to obtain the necessary financing in high-priced markets.

More than half of Canadians believe a $1-million budget is enough

There remains a stark discrepancy between how far a budget of $1 million will stretch in various regions across the country. Buyers located in some of Canada’s large urban centres often find themselves making more concessions on the type of home they can afford, even with a seven-figure budget, compared to those shopping in smaller, more affordable locations.

According to a recent Royal LePage survey conducted by Leger,[2] two thirds of Canadians (64%) believe that $1 million in today’s real estate market is a reasonable budget to afford a home that meets their household’s needs. This includes 22 per cent who say $1 million is ‘adequate’ and another 41 per cent say it is ‘more than enough’ to afford a home that meets their household’s needs in their current city or region. Meanwhile, 22 per cent say it is ‘not enough’.

Canadians residing in the country’s most expensive provinces are much less likely to feel that a $1-million budget is enough for a home purchase in their respective marketplace. Forty-five per cent of British Columbians and 31 per cent of Ontarians say that a budget of $1 million is ‘not enough’ to afford a home that meets their household’s needs in their current city, much higher than those living in Alberta (12%) and Quebec (8%).

“Finding employment has historically been one of the primary drivers for Canadians relocating to regions outside of major cities. Now, as housing affordability remains front and centre for many, we are seeing families move to new locations specifically to find a home within their budget, and prioritizing employment second,” said Yolevski. “The increased flexibility that the remote work movement has afforded many people makes this possible. We saw this phenomenon play out during the height of the pandemic, as the mass adoption of remote working enabled Canadians to migrate across the country.”

Of Canada’s three most populous provinces, Quebec residents are the most likely to agree that $1 million is a healthy sum for a home. Fifty-nine per cent of respondents in Quebec say that a budget of $1 million in today’s real estate market is ‘more than enough’ to afford a home that meets their household’s needs in their current city or region, and another 21 per cent say it is ‘adequate’. This is compared to respondents in Ontario and British Columbia, where 30 per cent and 18 per cent, respectively, say a budget of $1 million in today’s real estate market is ‘more than enough’ to afford a home that meets their household’s needs in their current city or region; and 24 per cent and 25 per cent, respectively, say it is ‘adequate’.

“Many buyers are expected to come off the sidelines this year as interest rates begin to come down. This increased activity will undoubtedly put upward pressure on property prices, perpetuating affordability challenges even as monthly carrying costs are reduced,” added Yolevski. “Without a significant increase in supply, especially in cities like Toronto and Vancouver, the standard for a $1-million property will continue to evolve away from large homes.”

REGIONAL SUMMARIES

Greater Toronto Area

The average home in the Greater Toronto Area (GTA) valued between $950,000 and $1,050,000 in December of 2023 had 3.0 bedrooms, 2.3 bathrooms and 1,459 square feet of living space – 301 square feet less than the national average. By comparison, the average home in the region valued between $1,950,000 and $2,050,000 in the same period had 3.8 bedrooms, 3.1 bathrooms and 2,692 square feet of living space – 191 square feet more than the national average.

“In the city of Toronto, $1 million is the entry-level price point for most property types. With this budget, a two-bedroom condominium or condo-townhome is realistic. If your budget is closer to the $2-million mark, then you can unlock larger and more updated properties in desirable downtown neighbourhoods. However, those who take their home search into the GTA’s suburbs can find much larger properties within this price range,” said Shawn Zigelstein, broker and team leader of Team Zold, Royal LePage Your Community. “Those shopping in the $1-million segment are mostly first-time buyers, newcomers and young families who are looking to transition from a rental into home ownership.”

Shawn Zigelstein noted that the number of homes sold over the $1-million threshold in the GTA has increased dramatically over the past six years, especially during the height of the pandemic real estate boom. As home prices continue to rise, the lower end of Toronto’s real estate market is facing increased demand and mounting upward price pressure. Buyers who can’t afford the required minimum 20 per cent down payment on a $1-million home will seek out more affordable housing options around the GTA.

The average home in the city of Toronto valued between $950,000 and $1,050,000 in December of 2023 had 2.8 bedrooms, 1.9 bathrooms and 1,218 square feet of living space – 241 square feet less than the average property in the greater region, and 542 square feet less than the national average. By comparison, the average home in the city valued between $1,950,000 and $2,050,000 in the same period had 3.5 bedrooms, 2.7 bathrooms and 2,075 square feet of living space; 717 square feet less than the average property in the greater region, and 526 square feet less than the national average.

Royal LePage 2024 Million-Dollar Properties Report Chart.

The release includes insights into the average size and specifications of properties in major regions across the country within the $950,000 to $1,050,000 price range and the $1,950,000 to $2,050,000 price range.